Simplify asset management

with our centralized collective account solution

Streamlines asset management by consolidating all customer accounts

into a single collective account.

Automatically generate consolidated orders from wealth management operations, ensuring real-time tracking

Efficiently manage assets in one centralized account for streamlined operations and enhanced security

A single platform with four distinct interfaces

For affiliates

Affiliates can easily access and manage their pension accounts, track investment performance, set their risk profile, and initiate transitions—all through a user-friendly interface.

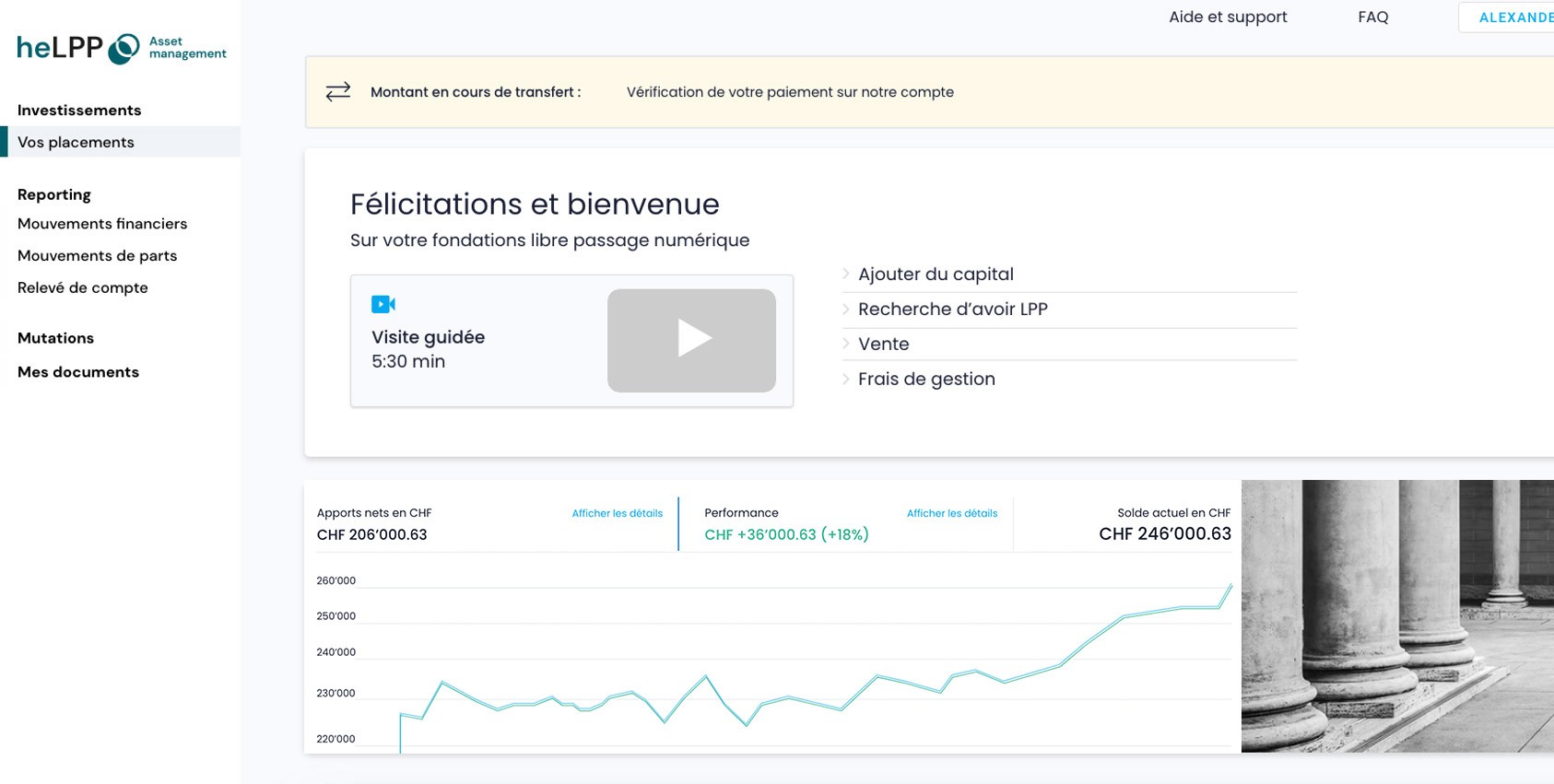

View account and investment performance

Affiliates can log in to check their portfolio, view their assets, and track the performance of their investments in real-time.

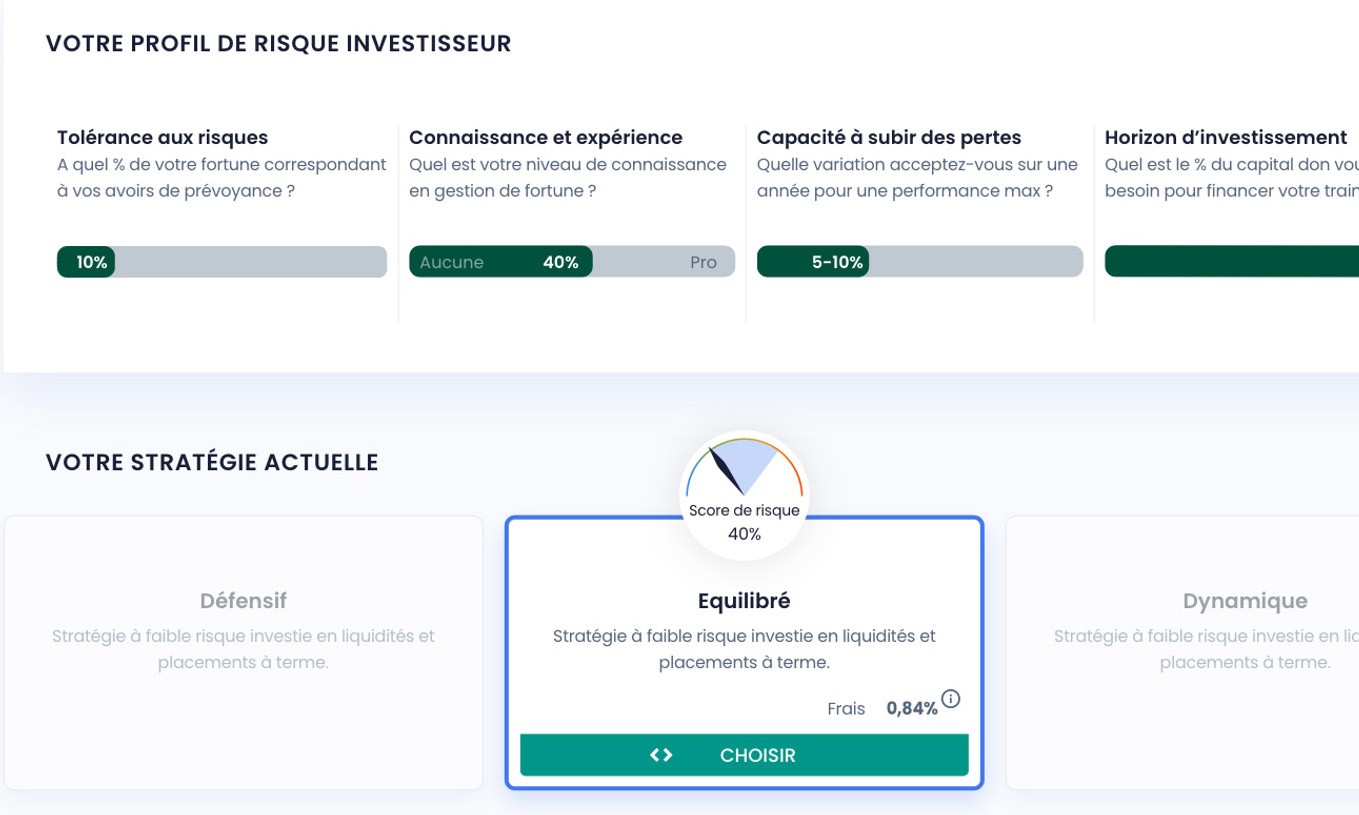

Set risk profile and choose strategy

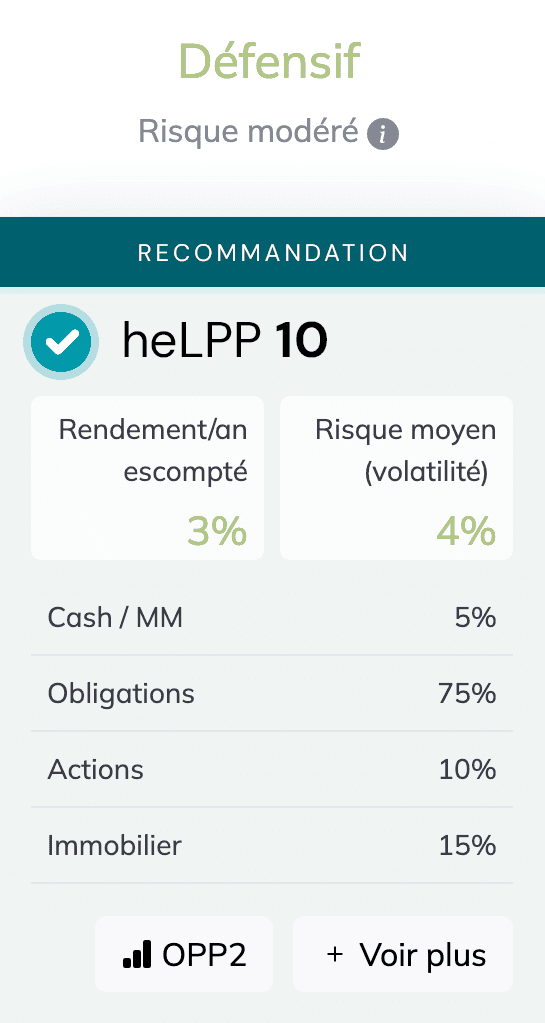

Affiliates can define their own risk profile and select an investment strategy that suits them, created by the wealth manager.

Track fees and financial movements

Affiliates have access to a detailed view of all fee deductions and financial transactions made on their account.

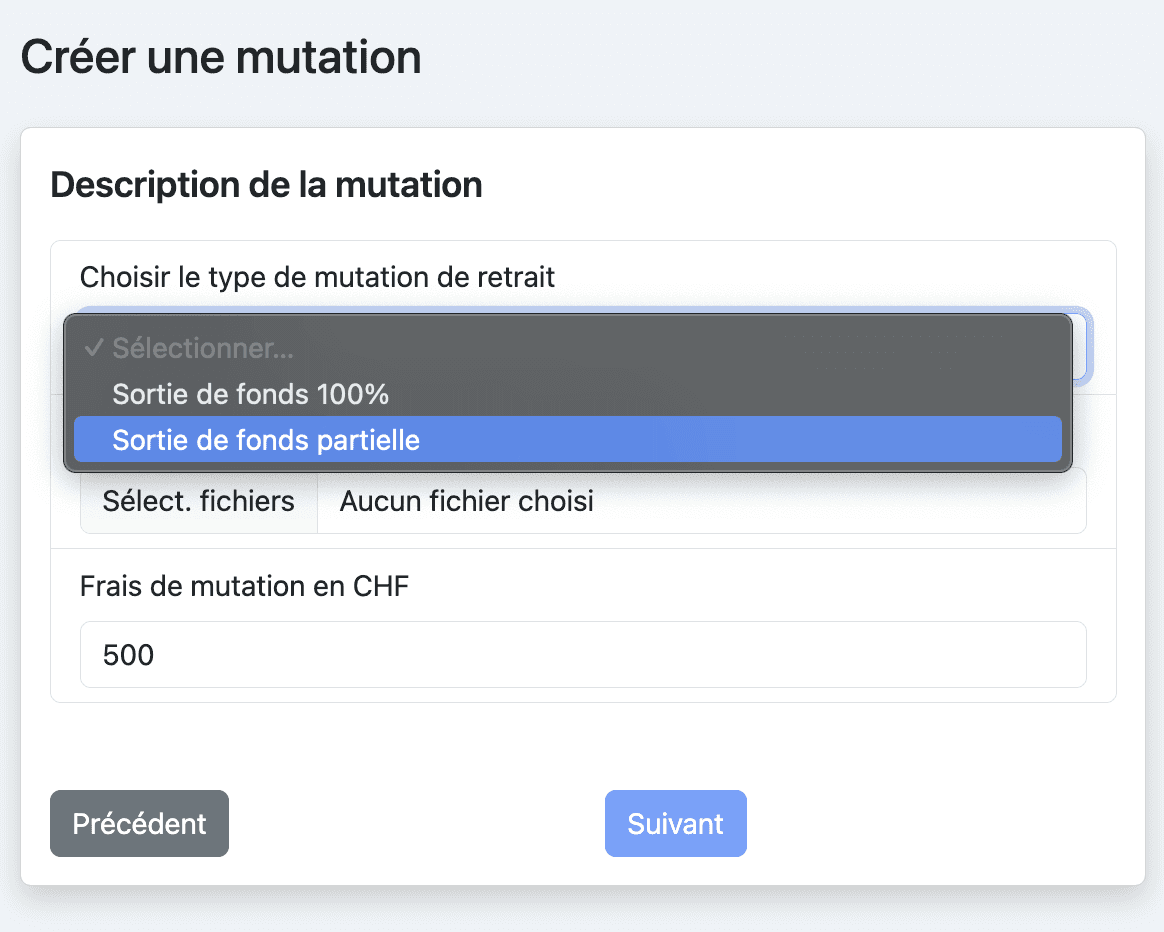

Initiate individual mutations

Through heLPP help desk, affiliates can independently initiate personal mutations (retirement, divorce, etc.), making it easy to manage their individual situations.

For wealth manager

Wealth managers benefit from a dedicated interface that centralizes portfolio management, strategy creation, order execution, and fee management, all while providing real-time insights into the financial health of each fund.

Real-time ebanking platform

heLPP offers a real-time connection to the depository bank, allowing managers to check the NAV of each fund and view cash balances. Open Banking integration ready

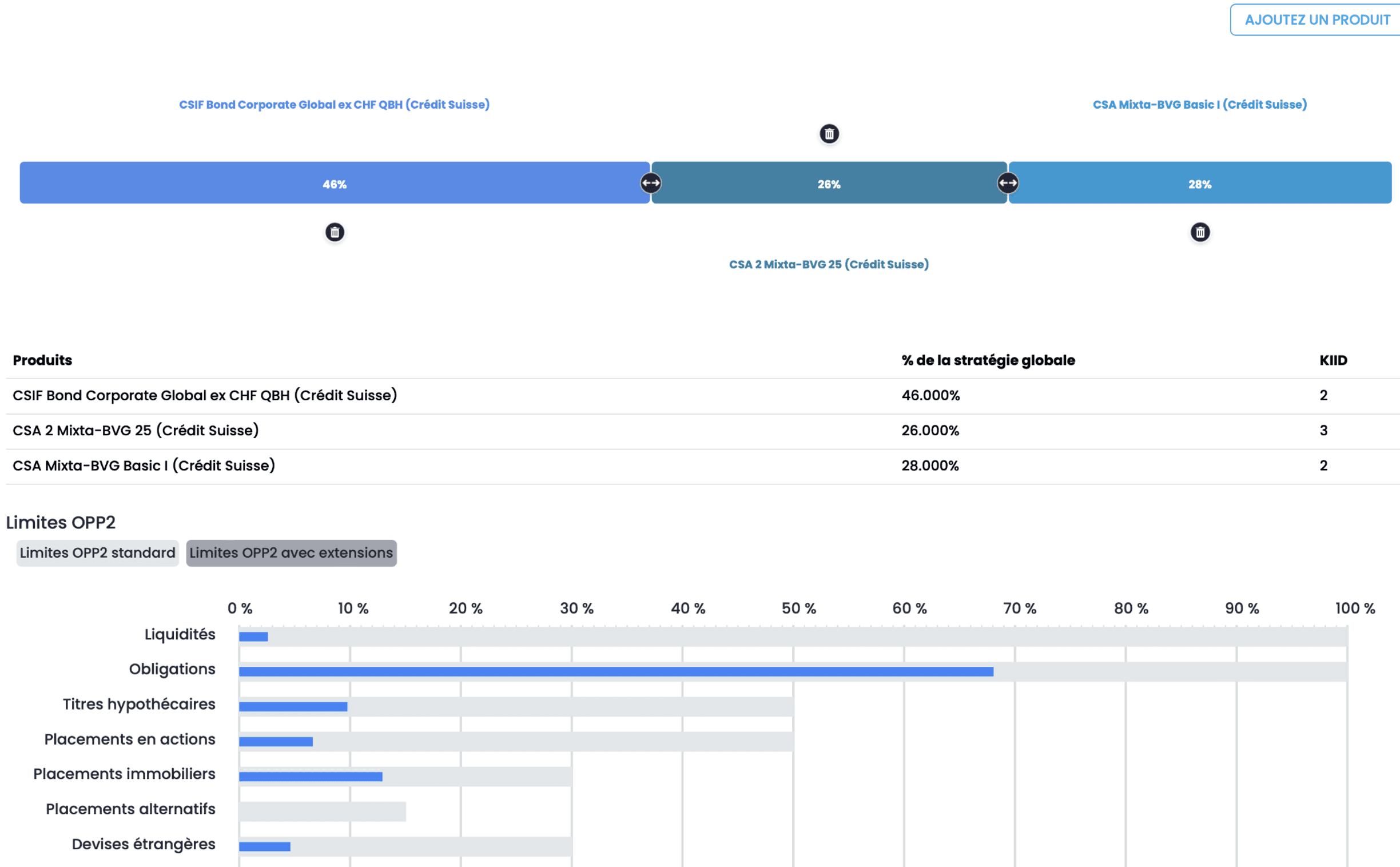

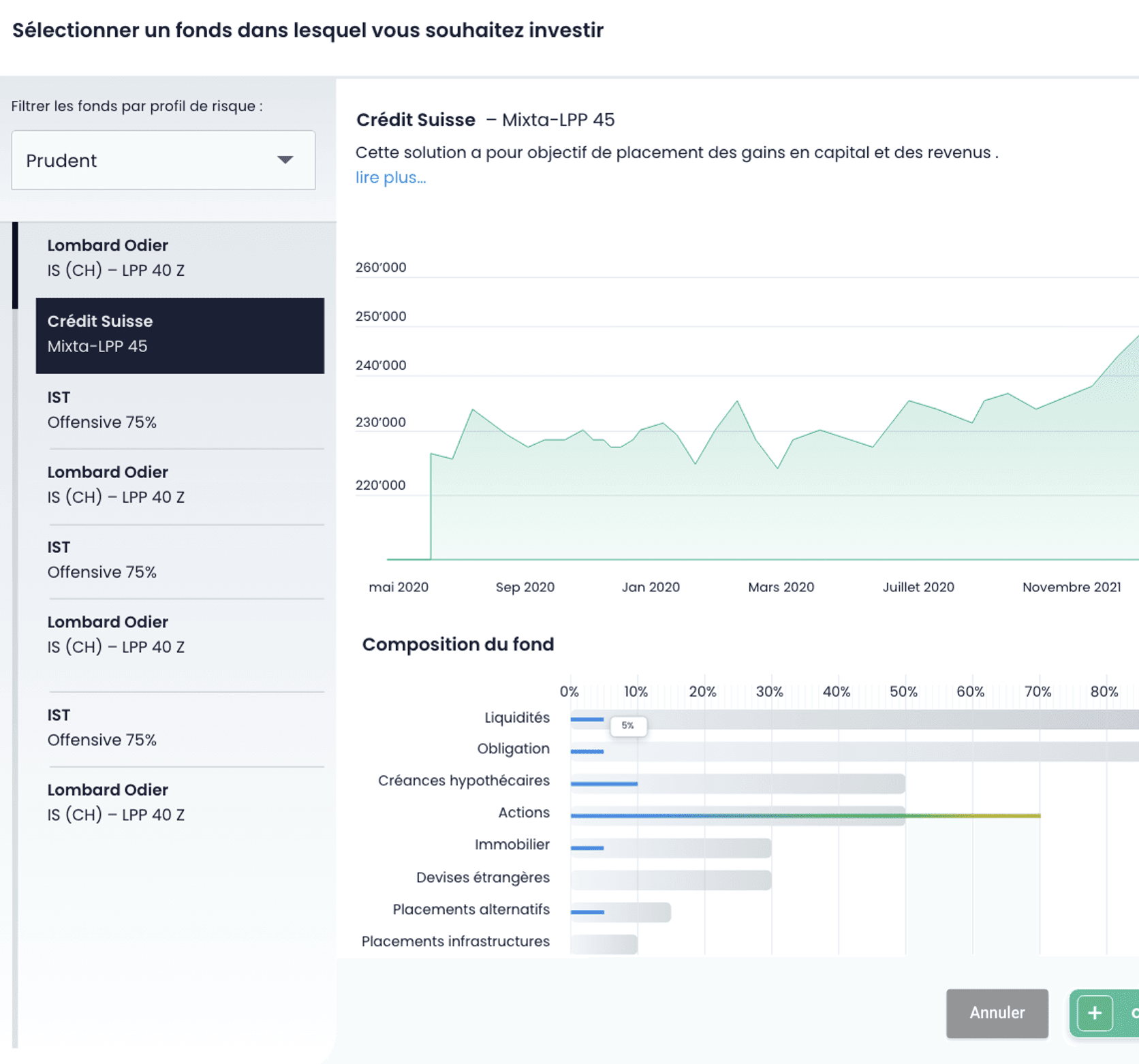

Create investment strategies

Wealth managers can create and propose personalized investment strategies to affiliates, offering a tailored management approach.

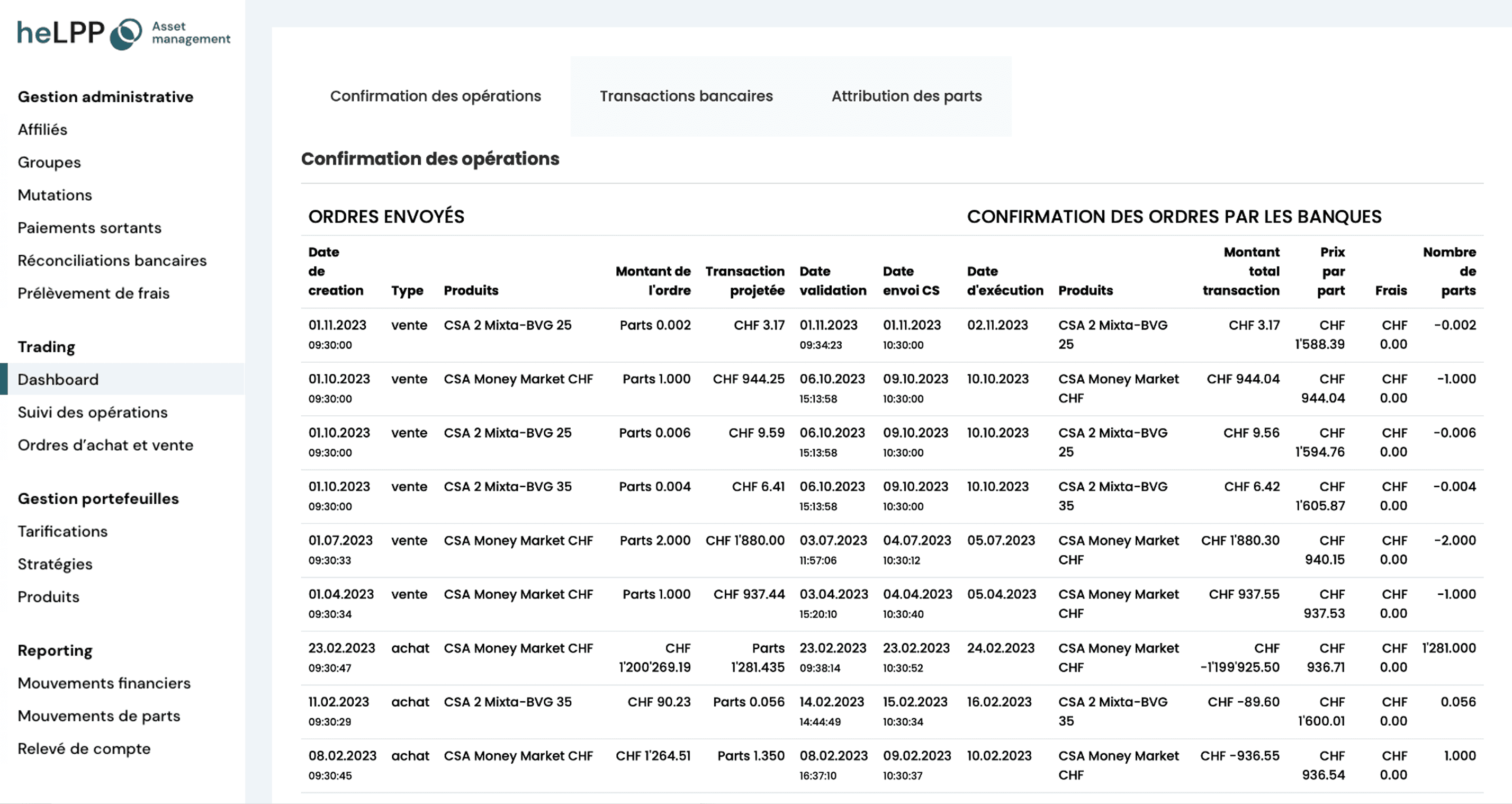

Pre-trade, trade, and post-trade views

Managers can track the entire order process from pre-trade to execution, with complete and transparent monitoring.

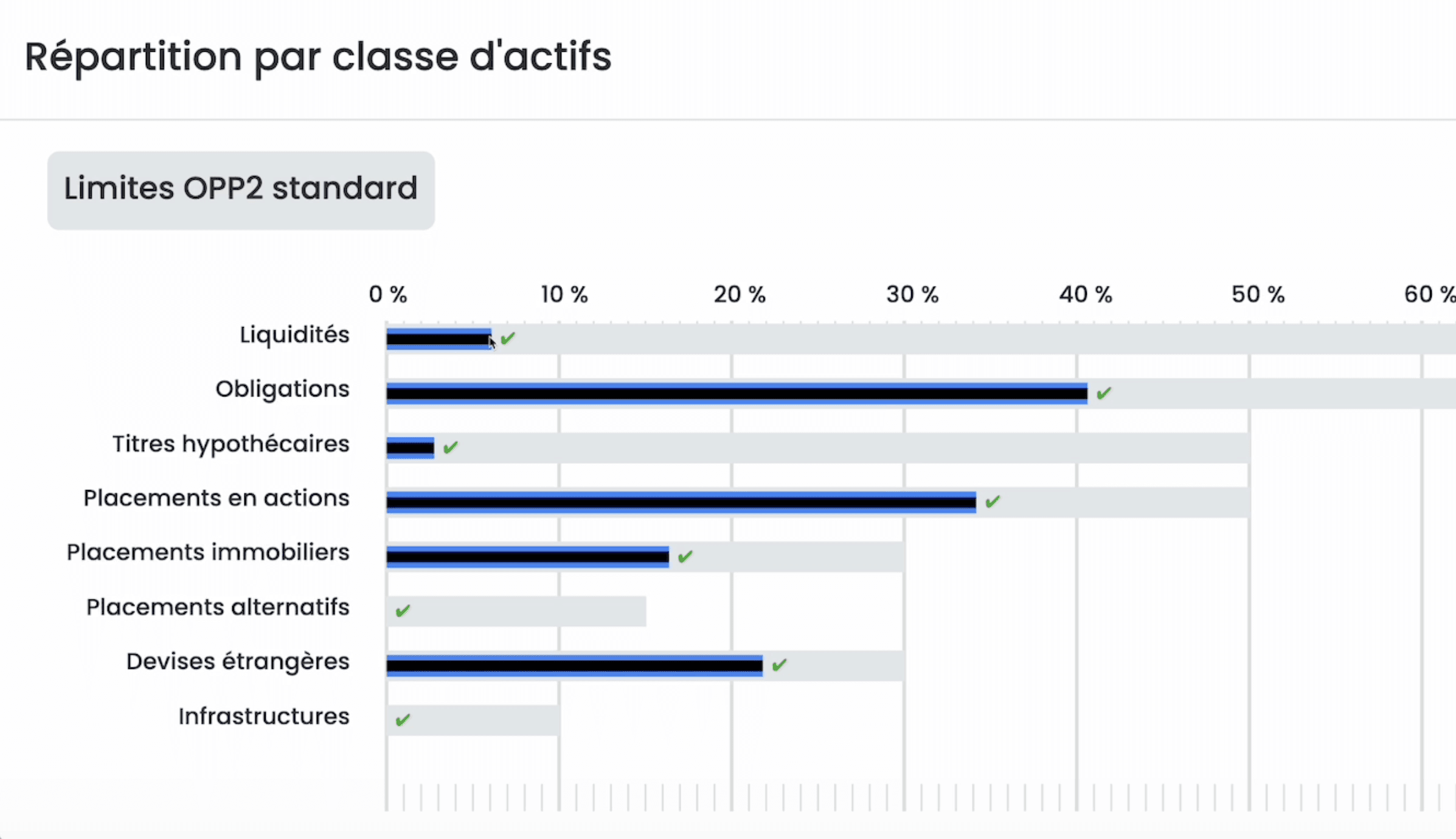

Suitability view and rebalancing

Managers have access to a suitability view to ensure that investments align with the target strategy, with the ability to trigger rebalancing if needed.

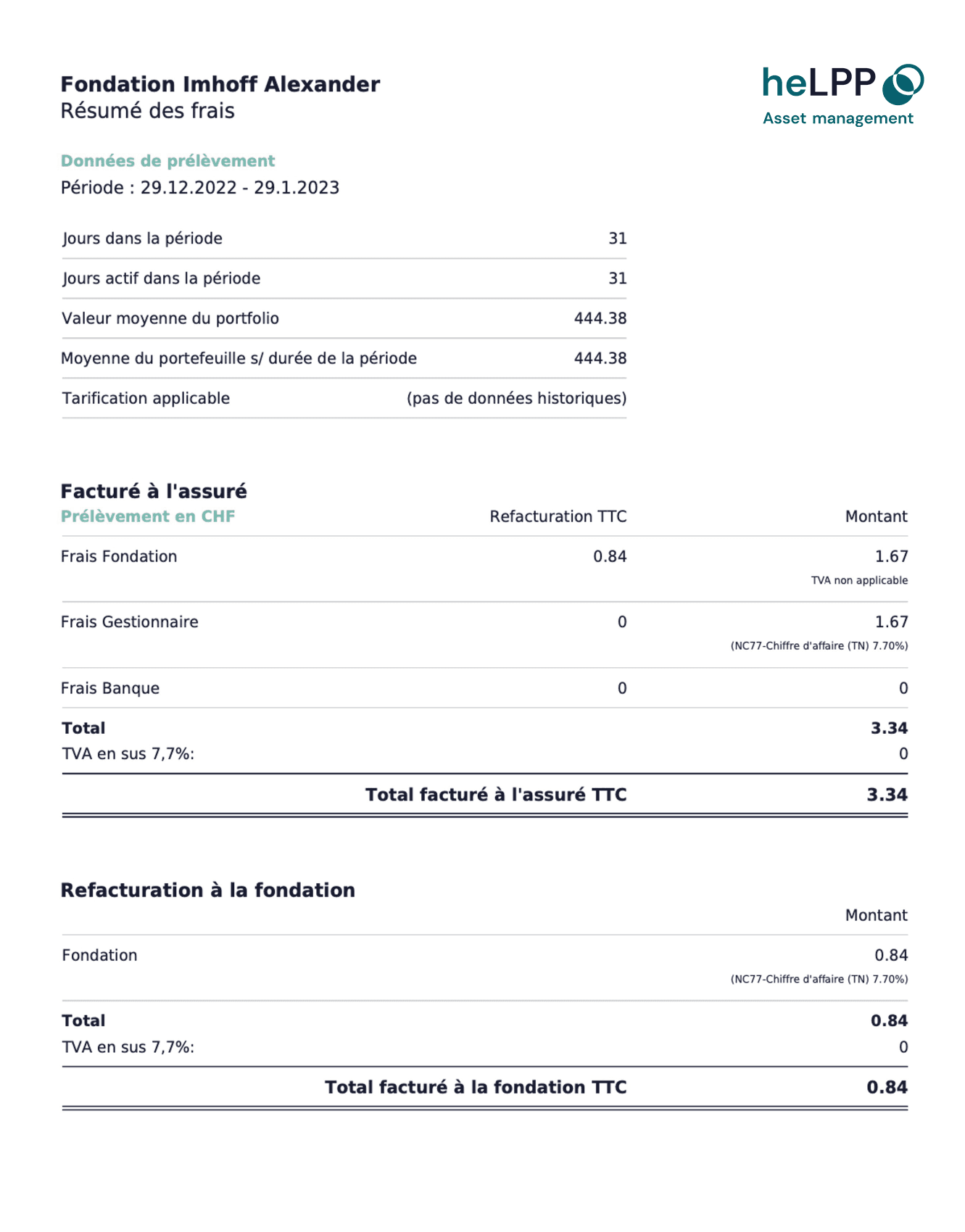

Automatic fee management

The system can automatically deduct fees by disinvesting affiliate assets, according to the fee schedule set by the manager.

Full control over order execution

While the platform may suggest orders, it is always up to the manager to validate final decisions, ensuring secure execution.

Order validation and execution

Managers can initiate operations such as rebalancing or assigning new strategies and validate orders for execution.

Outgoing cash payment management

The platform also allows for the execution of outgoing cash payments, such as partial withdrawals or fee payments to external accounts.

Simplified KYC

With a single account for the foundation, the KYC process is simplified, making client onboarding smoother and reducing banking formalities.

Simplified affiliate administration

Even if an affiliate doesn’t log in, the manager can administer their risk profile and assign an appropriate strategy, allowing for traditional management without requiring digital engagement from the affiliate.

Integration with existing PMS

Wealth managers can continue using their existing PMS while connecting to heLPP asset management for a seamless, centralized management experience.

For administrative management

Administrators have the tools to oversee affiliate accounts, execute investment orders following transitions, and generate detailed reports to ensure efficient operations and compliance.

View affiliates and their assets

Administrators can view the list of affiliates and track their assets in real-time through the platform.

Execute investment orders following individuals mutation

Administrators can issue investment orders to wealth managers as a result of individual mutations (e.g., retirement, divorce), ensuring seamless coordination between administrative and wealth management functions.

Export technical reports

The platform enables the export of technical management reports, including fee summaries and refactoring for foundations that have outsourced management to external providers.

For external wealth managers

External managers can onboard clients, assign investment strategies, and collaborate with the main wealth manager, while the platform ensures control over final order validation and accurate commission tracking.

Onboard external managers

The main wealth manager can onboard external managers who can then add clients through the platform.

Track clients and calculate commissions

The main manager can easily track the clients assigned to external managers and calculate their commissions based on the established fee structure.

Order validation by the main manager

Although external managers can advise and propose strategies, only the main manager is responsible for validating final orders.

Assign and advise on strategies

External managers can advise clients and assign suitable investment strategies under the supervision of the main manager.

Roadmap

heLPP Asset Management is constantly evolving to offer cutting-edge features to wealth managers and pension institutions. Our roadmap outlines the upcoming enhancements designed to optimize user experience and meet the specific needs of the sector.